#26: China's Shipbuilding Surge and Its Global Wake

Imagine a fleet so vast that it dwarfs nearly every other nation's shipbuilding capacity combined.

Imagine a fleet so vast that it dwarfs nearly every other nation's shipbuilding capacity combined.

In 2022, China's shipyards launched ships totalling over 100 million deadweight tonnage (DWT), holding about 49% of the global shipbuilding market.

That's right, China's shipbuilding industry has undergone a remarkable transformation, rising from humble beginnings to become the undisputed global leader.

In this edition of "Decoding The Dragon," we dive deep into the riveting currents of China's shipbuilding industry, tracing its journey from a modest player to a colossal titan that is reshaping global shipping and naval power.

We'll dive into the depths of this maritime revolution, exploring its history, current dominance, key players, and the waves it's making in the global arena.

So, let’s sail!

Anchoring the Past: The Early Days

China's shipbuilding journey began in the 1950s under Mao Zedong's leadership, with a focus on building a domestic fleet for national defense.

Thus that was largely under state-sponsored programs. However, it was not until the economic reforms of the late 1970s that the industry began to expand significantly.

And, the economic reforms of the 1980s truly set the industry sailing. Open-door policies, cheap labour, and government support propelled China's shipyards to the forefront of global shipbuilding.

Plus, China’s growing stature as the world’s factory for all things imaginable, and the government's heavy investment in infrastructure laid the keel for what was to become a shipbuilding revolution.

And outcome? The magic that followed in the 2000s.

Navigating Growth: The 2000s Expansion

The government's strategic vision to make China a maritime powerhouse led to the development of major shipyards like the China State Shipbuilding Corporation (CSSC) and China Shipbuilding Industry Corporation (CSIC).

And these have both today grown to two of the largest in the industry globally.

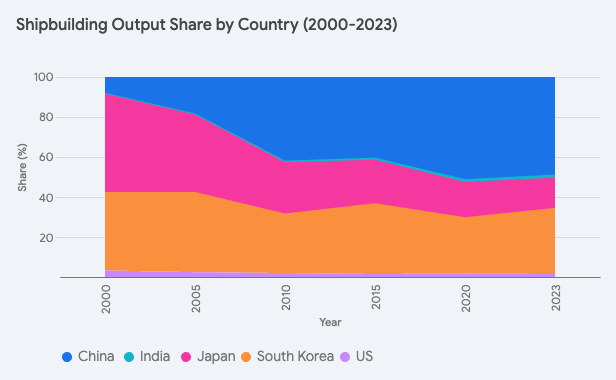

Led by them, by 2005, China surpassed South Korea & Japan for the first time in total shipbuilding output in dead weight tonnage.

And overall, by compressed gross tonnage too by 2010!

Today’s Fleet: A Global Behemoth

As of 2023, it reigns supreme, accounting for roughly 50% of the world's total shipbuilding output.

The industry is not just about quantity but also quality, with Chinese shipyards now building some of the world's largest container ships, oil tankers, and LNG carriers.

This dominance is evident across various vessel types, from bulk carriers and tankers to container ships and offshore platforms.

The Chinese shipbuilding industry is truly characterized by its massive scale and state-of-the-art technology.

..

Key Players: Navigating the Waters of Success Through Scale and Innovation

Several shipbuilding giants have emerged as key players in China's maritime dominance.

China State Shipbuilding Corporation (CSSC): A state-owned behemoth, CSSC is the world's largest shipbuilder by production capacity with a sprawling network of shipyards and subsidiaries. It has been a major player in China's naval modernization, also building advanced warships and submarines for the People's Liberation Army Navy (PLAN).

China Shipbuilding Industry Corporation (CSIC): Another state-owned giant, CSIC specializes in naval vessels, including aircraft carriers and destroyers. It has also made strides in the commercial shipbuilding sector, delivering various types of merchant ships and offshore platforms.

Jiangnan Shipyard Group: Known for its expertise in building high-tech and specialized vessels, Jiangnan Shipyard Group has constructed liquefied natural gas (LNG) carriers, chemical tankers, and even luxury yachts. The shipyard's focus on innovation has helped it secure lucrative contracts from numerous domestic and international clients, including Indian state-owned oil giants.

Beyond these titans, numerous smaller shipyards and suppliers contribute to the vibrant Chinese shipbuilding ecosystem.

These smaller players often cater to niche markets and specialized vessel types, adding diversity and resilience to the industry.

Tailwinds and Headwinds: Charting the Currents

The rise of China's shipbuilding industry has sent ripples across the global maritime landscape.

It has lowered shipbuilding costs, making ships more affordable for companies worldwide. This, in turn, has facilitated the growth of global trade and transportation.

And this has been made possible by significant government backing, which translates into subsidies and favourable policies.

However, having gotten thus far, it now faces the headwind of an ongoing global push towards greener technologies in shipping, challenging Chinese shipbuilders to innovate towards more environmentally sustainable solutions.

Additionally, geopolitical tensions, particularly with the US over trade policies and maritime sovereignty, continue to pose significant risks.

Policy Paddles: Steering Through State Support

The Chinese Government is definitely undeterred though.

Recent governmental strategies reflect a clear intent to uphold China's dominance in shipbuilding. For this, it is actively promoting the development of green shipbuilding technologies to reduce emissions and enhance energy efficiency.

Plus, the Belt and Road Initiative (BRI) also indirectly benefits the shipbuilding industry by increasing demand for new ships to bolster new maritime routes.

..

India and US: Contrasting Tides in the Shipbuilding Landscape

While China surges ahead, India and the US face distinct challenges in the shipbuilding sector.

India, despite its vast coastline and maritime potential, lags behind China in terms of infrastructure, technology, and competitiveness.

In 2023, Indian shipyards delivered a mere 3% of what Chinese shipbuilders did in terms of output. Nothing highlights the significant gap between the two nations.

And the US is faring much worse, given it was once a shipbuilding powerhouse.

It has seen its industry dwindle due to high labour costs and competition from lower-cost producers like China and South Korea.

Thus, the US shipbuilding industry now primarily focuses on building specialized vessels for the military and offshore energy sectors.

However, recent efforts to rebuild the domestic shipbuilding industry, such as the Jones Act, which requires ships carrying goods between US ports to be built and crewed by Americans, aim to revive this critical sector. Thus, that might help a bit. But again, that’s the hope.

Recent Developments: The Latest Waves

In 2023, China launched the world's first fully electric cargo ship, signalling a shift towards sustainable maritime technology.

Moreover, significant investments like the $5 billion infusion into upgrading shipbuilding facilities across the Eastern seaboard underscore China's commitment to maintaining its leading edge in shipbuilding technology and capacity.

Its impact on the global economy and trade is undeniable. And, as it sails into the future, the industry is set to encounter both choppy waters and favourable winds, but one thing is certain—it will continue to play a pivotal role in shaping global maritime trade and naval strategies.

Stay tuned for the next voyage in "Decoding The Dragon," where I’ll explore another critical aspect of China's industrial saga.

Very nice information , really loved it ,hope India become superpower on shipbuilding